Right click or tap and hold image to print, download, or enlarge image, or view the Residential Mortgage Documentation Checklist as a PDF.

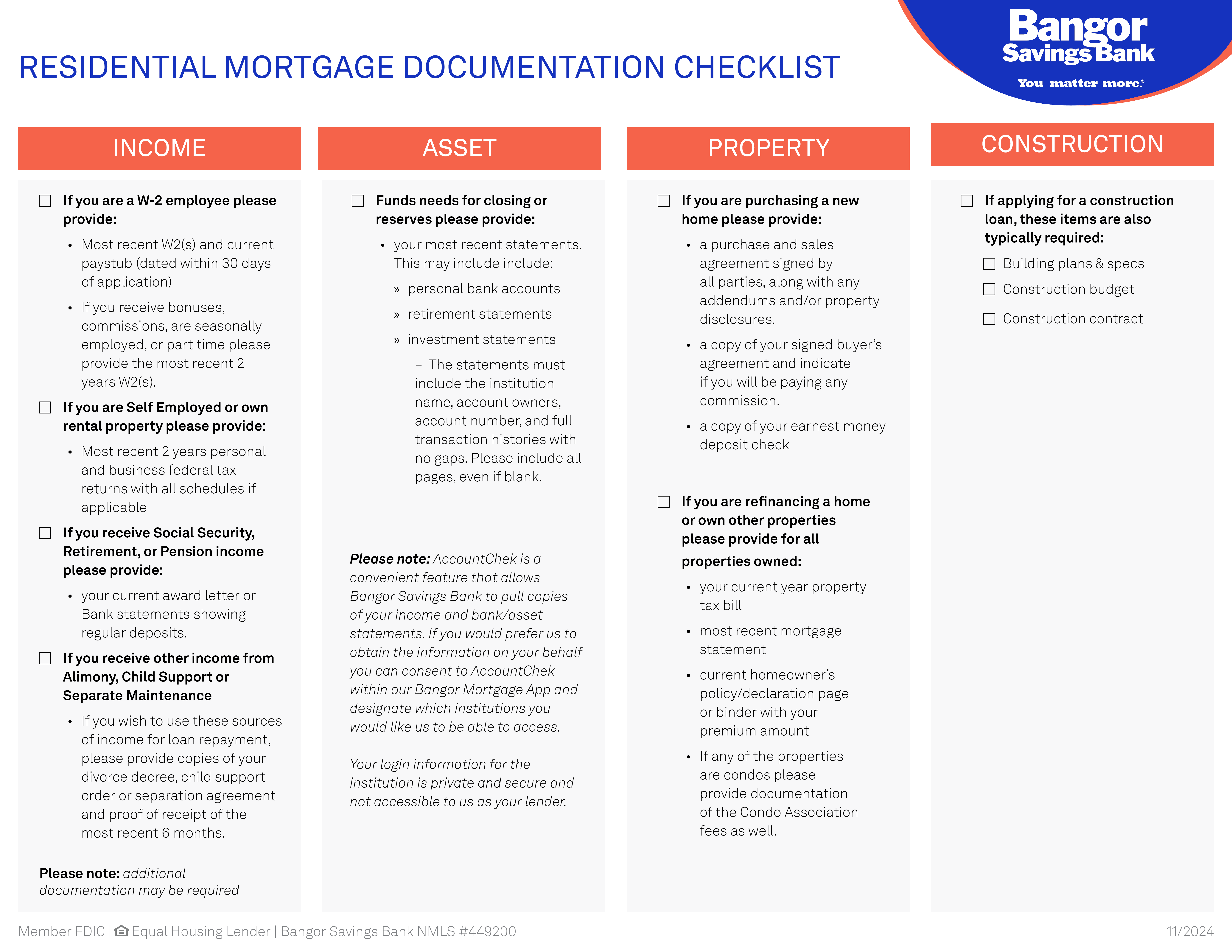

Income

If you are a W-2 employee please provide:

- Most recent W2(s) and current paystub (dated within 30 days of application)

- If you receive bonuses, commissions, are seasonally employed, or part time please provide the most recent 2 years W2(s).

If you are Self Employed or own rental property please provide:

- Most recent 2 years personal and business federal tax returns with all schedules if applicable

If you receive Social Security, Retirement, or Pension income please provide:

- Your current award letter or Bank statements showing regular deposits.

If you receive other income from Alimony, Child Support or Separate Maintenance

- If you wish to use these sources of income for loan repayment, please provide copies of your divorce decree, child support order or separation agreement and proof of receipt of the most recent 6 months.

Please note: Additional documentation may be required.

Asset

Funds needs for closing or reserves please provide:

- Your most recent statements. This may include include:

- Personal bank accounts

- Retirement statements

- Investment statements

- The statements must include the institution name, account owners, account number, and full transaction histories with no gaps. Please include all pages, even if blank.

Please note: AccountChek is a convenient feature that allows Bangor Savings Bank to pull copies of your income and bank/asset statements. If you would prefer us to obtain the information on your behalf you can consent to AccountChek within our Bangor Mortgage App and designate which institutions you would like us to be able to access.

Your login information for the institution is private and secure and not accessible to us as your lender.

Property

If you are purchasing a new home please provide:

- A purchase and sales agreement signed by all parties, along with any addendums and/or property disclosures

- A copy of your signed buyer’s agreement and indicate if you will be paying any commission

- A copy of your earnest money deposit check

If you are refinancing a home or own other properties please provide for all properties owned:

- Your current year property tax bill

- Most recent mortgage statement

- Current homeowner’s policy/declaration page or binder with your premium amount

- If any of the properties are condos please provide documentation of the Condo Association fees as well

Construction

If applying for a construction loan, these items are also typically required:

- Building plans and specs

- Construction budget

- Construction contract